Vietnam's stock market has no shortage of stocks with a tradition of paying high dividends of up to tens or even hundreds of percent. Most are manufacturing enterprises with stable profits, even growing year by year.

Buying stocks to "pay" dividends (cash) is not a rare investment strategy on the stock exchange but is sometimes "overshadowed" by waves of intense speculation. For those who like to surf, a few coins of dividends are just "extra food", having them is good but not having them is also okay. But besides that, there are also many investors who follow the school of "eat safe, wear long" and hold long-term to enjoy dividends.

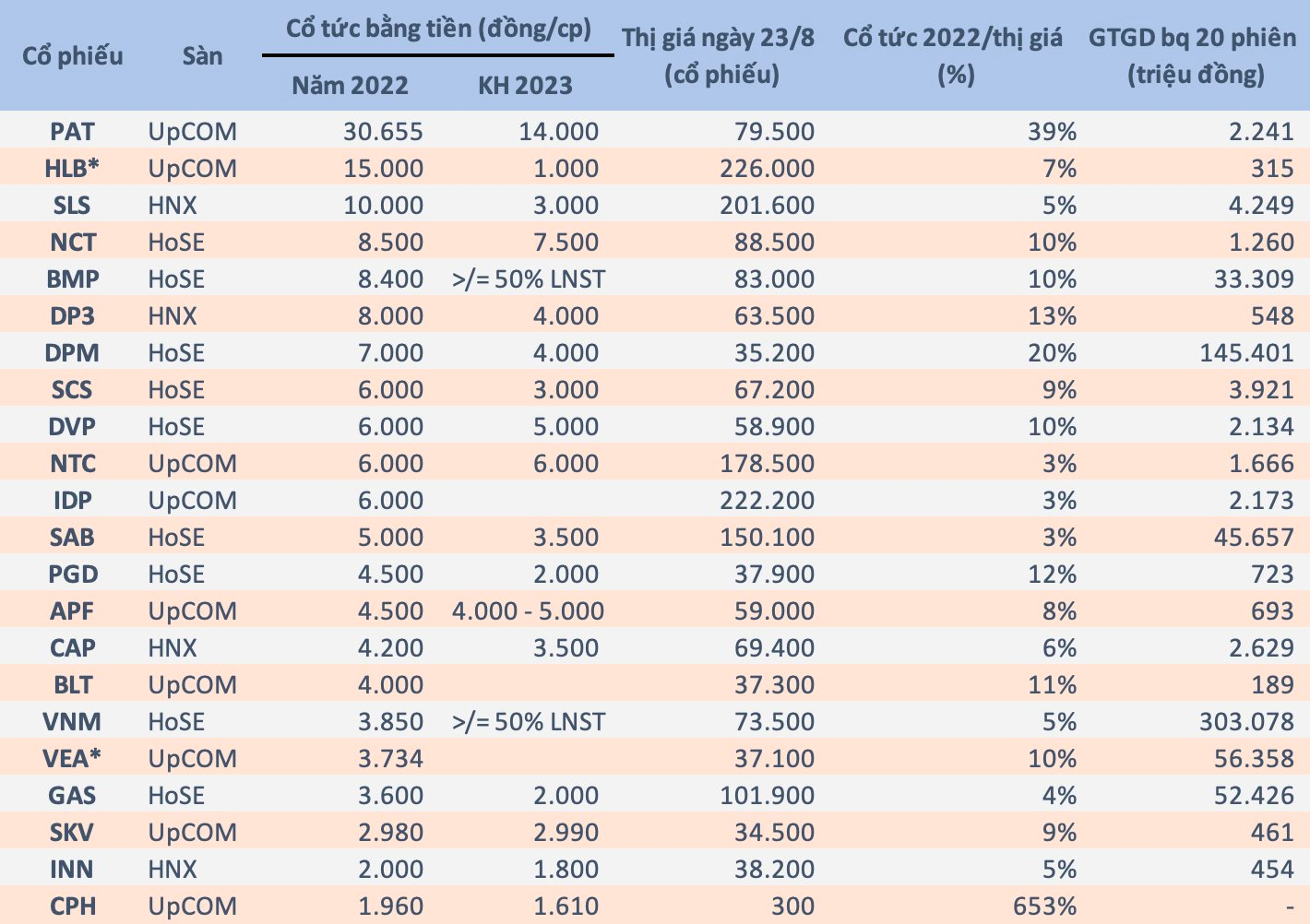

Fortunately, the Vietnamese stock market has no shortage of stocks with a tradition of paying high dividends of up to tens or even hundreds of percent. The "dividend-laying hens" are spread across all three exchanges with diverse scales from bluechips to midcap and penny.

The * sign is the dividend plan for 2022 but has not yet been paid

Investors can freely choose without worrying about liquidity issues. From individuals - the core of the market with modest capital to "big guys" with huge capital - everyone can make money. From a few hundred million to hundreds of billions, any capital size has suitable stocks to invest in.

The selection list includes many familiar names such as Vianmilk (VNM), Sabeco (SAB), Binh Minh Plastics (BMP), PV Gas (GAS), VEAM Corp (VEA), Central Pharmaceutical 3 (DP3) , Son La Sugarcane (SLS),... with a tradition of paying tens of % dividends each year. Even the "rookie", Vietnam Phosphorus Apatite (PAT), even played big when paying dividends up to 306.55% for 2022.

Most of last year's dividend rates/market prices of this group are quite attractive, higher than 12-month bank savings interest rates, even up to 2 digits. This is a desirable rate of return in the context of unfavorable market fluctuations. Adjusting the price when rolling dividends may be a short-term barrier, but there is no denying the value that long-term investment brings when holding these stocks.

Basically, consistently high dividends partly show the health of the business. The dividend policy is maintained regularly on the basis of "profitable, profitable" businesses. Stable profits, even growing year by year, will also be factors that push stocks in the market up. Therefore, long-term investors can "freely" enjoy compound interest by holding "affordable" stocks with high annual dividends.

It can be easily seen that groups with a tradition of paying regular high dividends every year are mostly in the manufacturing sector. These businesses regularly maintain stable profits, and in some cases grow, creating a premise for a liberal dividend policy. In addition, many of these are state-owned enterprises and paying high dividends is almost mandatory.

According to Decree 140/2020/ND-CP, state-owned enterprises hold more than 50% of charter capital or total voting shares, after distributing profits to capital contributors, compensating for losses of In the previous year, the bonus and welfare fund, the investment and development fund (maximum 30%), the remaining profit will be distributed to all dividends and profits in cash to shareholders.

This regulation allows shareholders of state-controlled enterprises such as PV Gas and VEAM Corp to feel secure with the annual dividend policy. Even state-owned enterprises that no longer hold controlling power such as Vinamilk, Sabeco, and Binh Minh Plastics do not hesitate to "deepen their pockets" when deducting almost all of their profits to pay annual dividends.

This is one of the factors that increases the attractiveness of these stocks in the eyes of foreign investors. Typically in the case of Thaibev at Vinamilk, Sabeco or SCG at Binh Minh Plastics, high annual dividends bring these corporations a stable cash flow, thereby partially compensating for the money spent to buy copper shares. time to have more resources to implement future plans.

Reality shows that the dividend investment strategy is not only attractive to individual investors but also to organizations. The clearest evidence is that the leading DC Business Investment Fund (DC Blue Chip Fund, DCBC) of Dragon Capital recently changed its investment objective to focus on regular income from interest and dividends instead of leading enterprises listed on the stock exchange as before.

According to the new strategy, DCBC will focus on spending 100% of fund assets on stocks of businesses with a history of paying regular dividends in the past or in the future in all industries. Notably, after the change in investment structure, there will be no investment in listed bonds, publicly offered bonds, or privately issued bonds.

The move of the "shark" DCBC (managed by Dragon Capital) is an affirmation of the position of the long-term "eating" dividend investment school that will never be outdated even in the context of a wave of speculation. dominate the stock market.

Post a Comment